U.S. federal regulators have swooped in on the crypto industry in May 2021 with new plans to regulate and tax digital asset ownership.

Introduction

The month of May has so far proven to be a rather unforgiving end of spring for the crypto industry, with markets resembling 2018’s crypto winter rather than a prelude to summer, as regulatory and institutional sentiment turned on Bitcoin and had retail investors sending out MayDays as their portfolios torpedoed nose-first.

After warning signs of impending closer regulatory scrutiny by the Biden administration, foreshadowed by the outgoing Treasury administration and FinCEN’s last-ditch efforts to regulate private wallets in December, a perfect storm hit the digital assets industry in the first half of May.

With the crypto market ballooning to a record size thanks to the efforts of crypto provocateur (conspiracy theorists say double agent) Elon Musk, President Joe Biden, and U.S. Treasury chief Janet Yellen made their plans to regulate and tax cryptocurrencies clear this month.

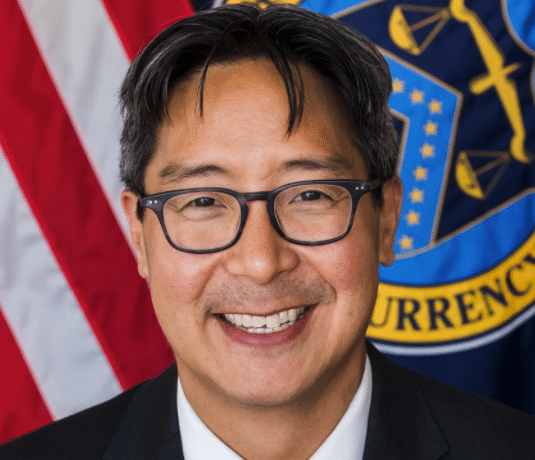

This was followed by new Acting Comptroller of the Currency, Michael Hsu, announcing that the OCC would be reviewing the progressive reforms of his predecessor and now Binance U.S. chief, Brian Brooks.

To add insult to perjury, the Securities and Exchanges Commission (SEC)’s new chairman Gary Gensler, the former MIT blockchain professor whose appointment many in the crypto space applauded with near messianic glee, let it be known as well that the crypto sector needed to be better regulated.

With the Financial Action Task Force (FATF) set to broaden the scope of their FATF guidance on Virtual Assets and Virtual Asset Service Providers (VASPs) and roll out new regulations for the likes of DeFi protocols and stablecoins in June, the stage is certainly set for a turbulent start of Q3 for digital asset investors and service providers.

Here follows a recap of the regulatory winds that blew the crypto sector around in May so far.

5/5: Treasury’s Janet Yellen Suggests New Regulatory Structure

In the first week of May, U.S. Treasury Secretary Janet Yellen acknowledged that the U.S. didn’t have a proper framework to regulate cryptocurrencies adequately. This followed Yellen’s largely negative assessment of crypto assets in February 2021 where she called Bitcoin extremely inefficient and found its connection with money laundering deplorable.

Her May comments alluded to the establishment of either a new agency or an interagency partnership to deal with crypto regulation:

“I think (for) cryptocurrencies we don’t really have an adequate framework to deal with the different issues that they pose from a regulatory perspective. There are issues around money laundering, the Bank Secrecy Act, use of digital currencies for illicit payments, consumer protection and the like...

And while there are several agencies that arguably have some ability to address this through regulation, I frankly don’t think we have a framework in the United States that is quite up to the task of putting in place a regulatory framework that we need in the future. I think that’s a topic that’s well worth addressing.”

5/6: Gensler Recommends Congress Regulate Exchanges

Gary Gensler’s appointment as the new SEC head drew praise from the crypto industry thanks to his proven deep knowledge of blockchain technology, more so than any other federal agency leader until now.

However, in Gensler’s first public hearing as SEC chairman, he said that while the SEC can only regulate securities and asset managers investing in crypto, he believed that Congress should provide regulatory clarity around crypto, and specifically, exchanges.

“Right now these exchanges do not have a regulatory framework at the SEC or at our sister agency, the Commodity Futures Trading Commission… there’s not a market regulator around these crypto exchanges and thus there’s really no protection around fraud or manipulation.”

Gensler’s comments were interpreted by some to imply that a federal regulatory framework would serve on top of the U.S.’ current state-by-state licensing framework for money transmitters, making it even more onerous to navigate for crypto exchanges, especially smaller ones with less human and financial resources. On the other hand, it could simplify matters, providing crypto exchanges with the choice to either follow state or federal regulatory regimes.

More bad news was to follow from the SEC a week later on May 12, when a staff statement published by the Division of Investment Management called Bitcoin highly speculative, with a potential for fraud. It also raised the alarm for mutual fund investors looking to trade risky Bitcoin futures.

With some of Bitcoin’s gains over the last year attributed to its increasing prospects of getting an exchange-traded fund (ETF) officially approved by the SEC, this statement suggested that such an event was still a long way off from becoming reality.

5/18- New OCC Chief Michael Hsu Wants to Review Brooks’ 2020 reforms

Much of 2020’s institutional adoption of digital assets can be attributed to the progressive reforms that Brian Brooks pushed through during his tenure at the helm of the U.S. federal banking regulator, the Office of the Comptroller of the Currency (OCC), making considerable progress in regulating cryptocurrencies and allowing financial institutions to not only hold them as official reserves but also offer them to their customers as custodial services.

However, new Acting Comptroller Michael Hsu dropped a bombshell on May 18 when he asked staff to review the work of his predecessor. Hsu said in prepared remarks released ahead of a House hearing that week:

“My broader concern is that these initiatives were not done in full coordination with all stakeholders,…Nor do they appear to have been part of a broader strategy related to the regulatory perimeter. I believe addressing both of these tasks should be a priority.”

Hsu requested a review of pending regulatory actions, which includes Brooks’ interpretive letters which clarified that federally chartered banks could custody and hold reserves for stablecoins.

Hsu’s review includes pending licensing decisions. Applications from crypto firms such as BitGo and BitPay will be subject to further scrutiny, while clarity will have to be delivered for previously conditionally approved OCC trust charters from Anchorage, Protego, and Paxos. This comes after the Senate Banking Chairman Sherrod Brown earlier expressed his concern over these crypto charters.

05/20- Treasury intends to crack down on crypto and narrow “tax gap”

On 23 April, President Biden shook the crypto industry with his plans to increase capital gains tax to 39.5% in the U.S.

The U.S. Treasury doubled down on Biden’s tax incentive to help fund his stimulus injections by announcing less than a month later that it would be seeking to crack down on crypto-asset markets and transactions in order to narrow a tax gap, obligating any transfer to the value of $10,000 and more to be reported to the Internal Revenue Service (IRS).

The Treasury Department said in a statement release:

“Cryptocurrency already poses a significant detection problem by facilitating illegal activity broadly including tax evasion. This is why the President’s proposal includes additional resources for the IRS to address the growth of crypto assets.

Within the context of the new financial account reporting regime, cryptocurrencies and crypto asset exchange accounts, and payment service accounts that accept cryptocurrencies would be covered. Further, as with cash transactions, businesses that receive crypto assets with a fair market value of more than $10,000 would also be reported on.”

Coupled with other negative news such as from the SEC (see below) as well as China’s new crypto ban, the price of Bitcoin tanked to $30,000 in a flash crash, the biggest since 2013.

05/20- Gensler calls for regulators to be ready to bring cases against bad actors

SEC chief Gary Gensler, said on Thursday, 20 May at a FINRA conference that US financial regulators were ready to take action and “bring cases” against bad actors in crypto and other emerging technologies in order to ensure investor protection.

“As we continue to stay abreast of those developments, the SEC and FINRA [the Financial Industry Regulatory Authority] should be ready to bring cases involving issues such as crypto, cyber, and fintech.”

Gensler specified that regulators should be ready to pursue misleading private funds, accounting fraud, insider trading, and other potential capital market exploitative behavior. While Gensler’s talk didn’t delve too much into specifics, it spelled an ominous warning to crypto investors after an SEC memo on 11 May pointed out Bitcoin’s volatility and the need to monitor suspicious activity in the crypto sector.

Conclusion

While the Biden administration has, until May, remained largely quiet on crypto regulations, unlike a number of Congress proposals to help ease the path for more crypto innovation and rules, it is now quite clear that they were working behind the scenes on how to effectively regulate this growing new financial sector and also tax it effectively.

With controversial new global AML/CFT recommendations from FATF expected to extend to new fields like decentralized finance (DeFi) and non-fungible tokens (NFTs) as well as clarity for the legality of stablecoins, the regulatory and legal landscape for the crypto space is set to change yet again.

This increasing oversight may not be as negative as most observers fear. As the first quarter of 2021 showed, greater institutional adoption of virtual assets is possible but will require greater regulatory certainty and legitimacy.

Considering the recent crypto circus in which new mainstream investors, many of them carrying little to no knowledge of crypto, were pulled into investing into Dogecoin at a vastly overvalued price and then losing most of their money when the price tanked, more coordinated and clearer regulation might do much to bring back a bit of the earlier luster to the appeal of cryptocurrencies for institutions.

If you’re a virtual asset service provider trying to meet the FATF Travel Rule’s compliance obligations and stay proactively ahead of AML/CFT requirements, please get in contact with Sygna product manager Vince Lee (services@sygna.io). Our Sygna Bridge and Sygna Gate solutions offer an integrated compliance service for both VASP-to-VASP transfers and VASP-to-unhosted wallet screening.

You can also visit our comprehensive “4 Compliance Lenses” series of articles to learn more about the technology, identification, implementation and governance challenges you’re facing and how to overcome this.

- Lens 1: Technology

- Lens 2: Identification

- Lens 3: Implementation

- Lens 4: (coming in June 2021)

Written by Werner Vermaak, Sygna Editor

This article constitutes the author’s opinions and does not necessarily reflect the views of CoolBitX or Sygna. It should be viewed for educational purposes only and not be interpreted as financial advice or political statements.