Table of Contents

2. What is the Financial Action Task Force (FATF)?

- 2.1 Overview

- 2.2 What is the FATF’s mandate?

3. The FATF’s Organizational Structure

- 3.1 What is the FATF Plenary?

- 3.2 The FATF Secretariat

- 3.3 The FATF Private Sector Consultative Forum (PSCF)

- 3.4 Who is the current FATF president?

- 3.5 FATF Plenary & FSRB Calendar (2019-June 2020)

4. The FATF Recommendations/ FATF Standards

- 4.1 The FATF 40 Recommendations

- 4.2 The FATF 9 Special Recommendations on Terrorist Financing

- 4.3 The FATF Interpretive Notes

- 4.4 The FATF Standards

5. The FATF’s Network of Members, Regional Bodies and Affiliated Organizations

- 5.1 The FATF’s 39 Member Countries and Special Jurisdictions

- 5.2 What are FATF-Style Regional Bodies (FSRBs)?

- 5.3 The FATF Observer Organizations

6. Complying with the FATF Standards

- 6.1 FATF Assessment Methodology

- 6.2 The FATF graylist of high-risk monitored countries

- 6.3 The FATF blacklist of Non-Compliant Countries or Territories (NCCTs)

7. The FATF and the Cryptocurrency Industry

1. Introduction

The year 2019 marked decisive changes in the way regulatory authorities view and police the use of cryptocurrencies. Where users of virtual assets enjoyed relative anonymity for the first decade of this new asset’s class’ existence, the ability and usage of virtual assets to facilitate money laundering and finance terrorism have led to more stringent regulatory action this year.

The Financial Action Task Force (FATF), the world’s global AML/CFT regulator against money laundering and terrorism funding, has forced fundamental and permanent changes in the crypto industry this year. In this guide, we investigate the origins and purpose of the FATF, as well as its structure and operations.

2. What is the Financial Action Task Force (FATF)?

2.1 Overview

The Financial Action Task Force (FATF) is an intergovernmental organization that was established by the G7 nations in 1989 during a summit in Paris, France. The task force was created in response to the difficulties nations experienced in trying to cooperate and enforce an effective global Anti-Money-Laundering (AML) policy. In October 2001, as a direct response to the 911 attacks, the FATF’s mandate was expanded to also include the Combating of Terrorism Funding (CFT). This year (2019) marks the 30th anniversary of the FATF’s inception.

The FATF is located at the Organisation for Economic Co-operation and Development (OECD) headquarters in Paris, France and is known as GAFI (Groupe d’Action Financière) in French. While several of their member countries overlap, the FATF and OECD are completely separate organizations. In fact, FATF is actually not a formal global organization but instead, as its name suggests, a combined regulatory watchdog whose member countries temporarily fund it to undertake projects and achieve the mandate they provide it with.

As a result, the FATF only focuses on policy-making and doesn’t pursue AML/CFT transgressors. Instead, it leaves prosecution in the hands of regional law enforcement agencies and Financial Intelligence Units (FIUs), for example, FinCEN (U.S.), NCA (UK), Tracfin (France).

The main objectives of the FATF are clear. It sets standards and promotes the efficient implementation of legal, regulatory and operational measures to combat money laundering, terrorism funding and other issues that threaten the integrity of the global financial system.

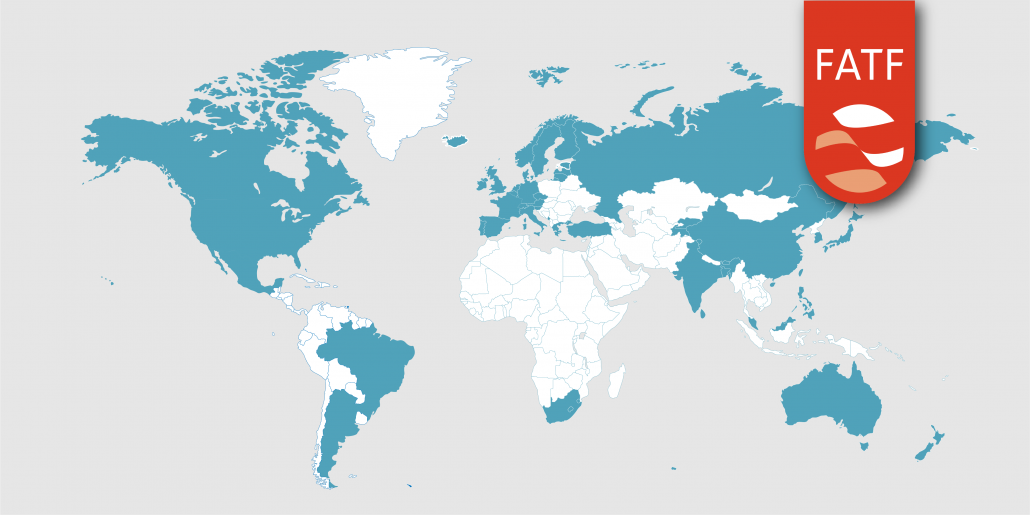

The FATF currently has 39 countries and jurisdictions as members around the world, covering the world’s biggest economies. In addition, these countries are also members of 9 FATF-like regional bodies (FSRBs) around the globe, which helps the FATF to extend its reach to over 200 nations worldwide.

In order to force countries to adhere to recommendations, the FATF manages a graylist and blacklist of non-compliant countries in the fight against money laundering and terrorist funding. The FATF presidency rotates annually and on 1 July 2019, the U.S.’s Marshall Billingslea was succeeded by China’s Xiangmin Lu.

2.2 What is the FATF’s mandate?

The FATF has a mandate to respectively combat money laundering, and after the 911 attacks in 2001, the funding of terrorism-related activities.

During an emotional FATF Plenary in October 2001, mere weeks after the September 11 tragedy, the FATF vowed to combat international terrorism by issuing new recommendations aimed at cutting off financial avenues of funding to terrorists, and imploring (and succeeding in persuading) other nations to adopt the “Special Eight Recommendations” (now nine).

3. The FATF’s Organizational Structure

3.1 What is the FATF plenary?

The FATF plenary is FATF’s senior decision-making body that convenes three times a year, usually during October, February, and June (the plenary year begins on 1 July). During plenary meetings, senior officials from member countries discuss the plenary’s agenda in order to produce implementable outcomes.

In addition to the plenary meetings, the FATF also holds inter-sessional meetings, a meeting of typology experts and conferences with other organizations. Any FATF meeting can only be attended by member delegations and observer jurisdictions and organizations and are never open to the public. During a plenary, the FATF can expect to hear feedback from observer organizations that include the UN, IMF, World Bank, OECD, OSCE, and the 9 FATF-Style Regional Bodies.

In June 2019, Pres. Billingslea of the United States finished his plenary year by ensuring that Recommendation 16’s so-called crypto travel rule was formalized. In October 2019, the first plenary under China’s Xiangmin Liu’s presidency was held in Paris. We’ll discuss the results of these plenaries in more detail later.

3.2 What is the FATF secretariat?

The FATF Secretariat helps governments coordinate and collectively implement an efficient global AML/CFT policy in over 200 jurisdictions. The current Executive Secretary is David Lewis (since 2015).

Mr. Lewis and his team of 40 staff members carry out 4 core duties: monitoring, development, assessment, and training:

- They monitor how terrorists raise and access funds and, and which methods are used to launder money.

- They develop worldwide standards, best practice and recommendations to mitigate new risks

- They assess how governments are responding to these new risks

- They train officials from countries that support FATF

3.3 What is the FATF Private Sector Consultative Forum (PSCF)?

The FATF’s Private Sector Consultative Forum is held annually in May, normally in Vienna, Austria. This invitation-only conference allows the FATF to get the private sector’s input on current and intended changes to the Recommendations and AML/CFT strategies.

In May 2019 the FATF invited 300 crypto industry leaders (including CoolBitX CEO Michael Ou) and advocates to a consultative meeting in Vienna, Austria, as the last chance to voice their opinions before the FATF finalized the new so-called “Travel Rule” recommendations. Discussions were hot-tempered at times and illuminated the divide between the industry and regulators and banks. The next PSCF is scheduled for 4-8 May 2020 in Vienna, Austria.

3.4 Who is the current FATF president?

The FATF’s presidency is a rotating position with a one-year term that begins on the 1st of July each year and terminates on the 30th of June the next year. Each FATF president is appointed by the FATF Plenary from senior officials from the organization’s members. The FATF president acts as convenor and chairman of FATF plenary meetings and also oversees the FATF Secretariat

Xiangmin Liu of the People’s Republic of China assumed the position of President of the FATF on 1 July 2019. He succeeded Marshall Billingslea of the United States.

Mr. Liu has an extensive background in AML regulations. He previously served as head of China’s FATF delegation and developed and implemented China’s AML/CFT policies and practiced law at a top New York firm. He is the current Director-General of the Legal Department at the People’s Bank of China(the PRC’s central bank) where he is tasked with the development of key financial laws, policies, and regulations. Liu holds a Ph.D. in political economy from Yale Law School and a degree in Economics from Peking University.

3.5 FATF & FSRB Calendar for 2020

The FATF network has a busy 7 months left until its June Plenary, with several meetings scheduled with its regional bodies, as well as a February Plenary, PSCF and experts meeting. View the official FATF calendar here.

4. The FATF Recommendations/ FATF Standards

The Financial Action Task Force issues legally non-binding recommendations to its member countries that act as guidelines which they are expected to enforce. Essentially, it sets rules and standards that FATF members must apply domestically and checks to see if countries are implementing its recommendations. These recommendations are interchangeably referred to as the FATF Recommendations or FATF Standards ( which includes the 9 Special Recommendations and Interpretive Notes). The FATF Standards were comprehensively updated in 2012.

4.1 The FATF 40 Recommendations and 9 Special Recommendations (FATF 40+9)

In 1990, the FATF issued the 40 Recommendations on Money Laundering, which was followed in the wake of September 11 with the 9 Special Recommendations on Terrorism Funding (issued in 2001). Together, these guidances made up The FATF Recommendations (also known as the 40+9 Recommendations).

The FATF Recommendations are frequently updated and are considered to be the universal standard in Anti-Money Laundering (AML) and Combating the Financing of Terrorism(CFT) endeavors. They act as a simple framework to aid the detection, prevention, and eradication of terrorism funding.

Here is a list of the FATF’s 40 Recommendations, with main categories:

AML/CFT POLICIES AND COORDINATION

- Recommendation 1: Assessing risks and applying a risk-based approach

- Recommendation 2: National cooperation and coordination

MONEY LAUNDERING AND CONFISCATION

- Recommendation 3: Money laundering offense

- Recommendation 4: Confiscation and provisional measures

TERRORIST FINANCING AND FINANCING OF PROLIFERATION

- Recommendation 5: Terrorist financing offense

- Recommendation 6: Targeted financial sanctions related to terrorism and terrorist financing

- Recommendation 7: Targeted financial sanctions related to proliferation

- Recommendation 8: Non-profit organizations

PREVENTIVE MEASURES

- Recommendation 9: Financial institution secrecy laws

- Recommendation 10: Customer due diligence

- Recommendation 11: Record-keeping

- Recommendation 12: Politically exposed persons

- Recommendation 13: Correspondent banking

- Recommendation 14: Money or value transfer services

- Recommendation 15: New technologies

- Recommendation 16: Wire transfers

- Recommendation 17: Reliance on third parties

- Recommendation 18: Internal controls and foreign branches and subsidiaries

- Recommendation 19: Higher-risk countries

- Recommendation 20: Reporting of suspicious transactions

- Recommendation 21: Tipping-off and confidentiality

- Recommendation 22: DNFBPs: customer due diligence

- Recommendation 23: DNFBPs: Other measures

TRANSPARENCY AND BENEFICIAL OWNERSHIP OF LEGAL PERSONS AND ARRANGEMENTS

- Recommendation 24: Transparency and beneficial ownership of legal persons

- Recommendation 25: Transparency and beneficial ownership of legal arrangements

POWERS AND RESPONSIBILITIES OF COMPETENT AUTHORITIES AND OTHER INSTITUTIONAL MEASURES

- Recommendation 26: Regulation and supervision of financial institutions

- Recommendation 27: Powers of supervisors

- Recommendation 28: Regulation and supervision of DNFBPs

- Recommendation 29: Financial intelligence units

- Recommendation 30: Responsibilities of law enforcement and investigative authorities

- Recommendation 31: Powers of law enforcement and investigative authorities

- Recommendation 32: Cash couriers

- Recommendation 33: Statistics

- Recommendation 34: Guidance and feedback

- Recommendation 35: Sanctions

INTERNATIONAL COOPERATION

- Recommendation 36: International instruments

- Recommendation 37: Mutual legal assistance

- Recommendation 38: Mutual legal assistance: freezing and confiscation

- Recommendation 39: Extradition

- Recommendation 40: Other forms of international cooperation

The FATF’s 9 Special Recommendations on Terrorist Financing

After the devastating terrorist attacks in September 2001, the FATF convened and added the combating of terrorism financing to its mission. In October 2001, the FATF released the Eight Special Recommendations that specifically terrorism funding. In response to evolving and refund money laundering methods, the task force updated its Standards comprehensively in 2003 and published the Ninth Special Recommendation in 2004 to strengthen its policies and network of AML/CFT organizations around the world. Since then, the FATF guidances are known as the 40+9 Recommendations around the world. Read more about each special recommendation here.

Here are the 9 Special Recommendation subjects:

| I. | Ratification and implementation of UN instruments |

| II. | Criminalising the financing of terrorism and associated money laundering |

| III. | Freezing and confiscating terrorist assets |

| IV. | Reporting suspicious transactions related to terrorism |

| V. | International co-operation |

| VI. | Alternative remittance |

| VII. | Wire transfers |

| VIII. | Non-profit organisations |

| IX. | Cash couriers |

4.2 The FATF Interpretive Notes

The 40+9 Recommendations provide a thorough and consistent framework to aid countries with their AML/CFT implementation. However, not all countries can implement the same measures, due to vast cultural, financial, legal and operational obstacles. Therefore, the FATF often issue interpretive notes in order to help create a consistent global approach for countries.

4.3 The FATF Standards

null

null

The FATF guidances are not set in stone and have to be updated periodically keep up with changes in technology, criminal behavior, and security concerns. There are currently nearly 30 interpretive notes that have been issued by FATF in reaction to worldwide societal, political and economic differences and changes to complement and update the FATF Recommendations. For a full list, click here.

In 2012, the FATF plenary adopted the comprehensively updated and published FATF Recommendations: International Standards on Combating Money Laundering and the Financing of Terrorism and Proliferation, which includes both the 40+9 Recommendations and Interpretive Notes and is referred to colloquially as both the FATF Recommendations or FATF Standards. The FATF made its latest update in June 2019, with the adoption of the Interpretive Note on Recommendation 16.

5. The FATF’s Network: Members, Regional Bodies and Affiliated Organizations

The Financial Action Task Force currently has 39 member countries and special jurisdictions who all help to set its standards during a plenary and develop regional frameworks in their respective FATF-style Regional Bodies (FSRBs) where more than 200 countries are involved.

5.1 The FATF’s 39 Member Countries and Special Jurisdictions

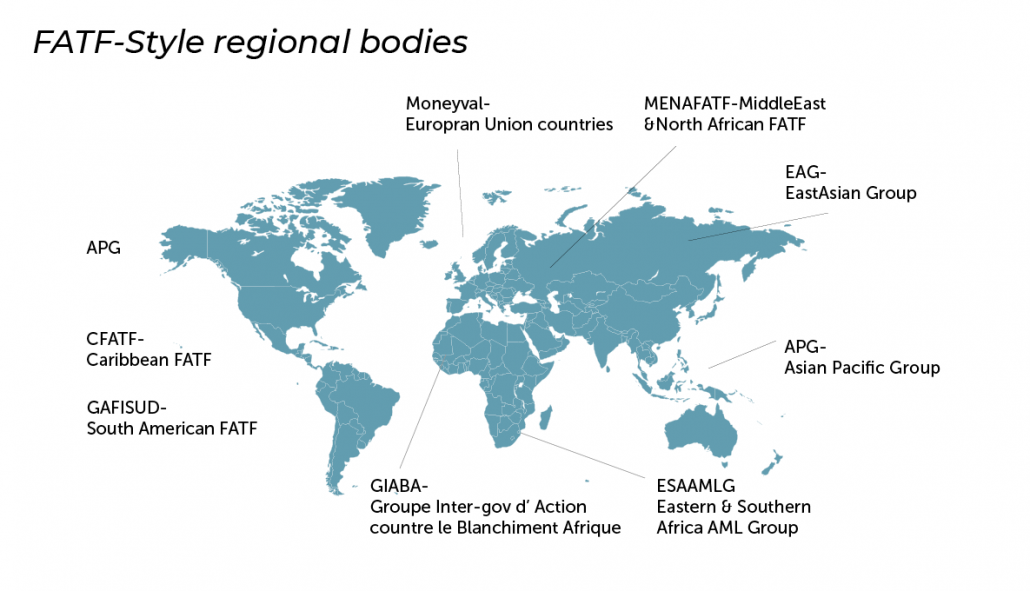

5.2 The Nine FATF-Style Regional Bodies (FSRBs)

The 9 FATF-Style Regional Bodies conduct AML/CFT policy developments on every continent, helping its 200+ countries understand and meet FATF’s expectations.

| Acronym | Full Name | City | Country |

| APG | Asia/Pacific Group on Money Laundering | Sydney | Australia |

| CFATF | Caribbean Financial Action Task Force | Port of Spain | Trinidad & Tobago |

| EAG | Eurasian Group | Moscow | Russia |

| ESAAMLG | Eastern & Southern Africa Anti-Money Laundering Group | Dar Es Salaam | Tanzania |

| GABAC | Central Africa Anti-Money Laundering Group | Libreville | Gabon |

| GAFILAT | Latin America Anti-Money Laundering Group | Buenos Aires | Argentina |

| GIABA | West Africa Money Laundering Group | Dakar | Senegal |

| MENAFATF | Middle East and North Africa Financial Action Task Force | Manama | Bahrain |

| MONEYVAL | Council of Europe Anti-Money Laundering Group | Strasbourg | France |

Which 200+Countries belong to the 9 FSRBs?

The FATF-Style Regional Bodies count over 200 countries and jurisdictions as members. For a full list and to see which countries belong to which FSRBs, click here.

5.3 The FATF Observer Organizations

Over 25 very influential international organizations with specific AML operations currently have observer status with the FATF. These bodies frequently meet and collaborate with the FATF to develop specific frameworks and to help maintain a consistent international AML/CFT policy.

For example, the International Monetary Fund (IMF) has endorsed the FATF’s Recommendations and developed supportive methodologies since 2004. The IMF boosts the FATF’s AML/CFT activities in a number of ways, such as providing a global forum to share information, promoting beneficial policies, creating common approaches to difficult issues and sharing its considerable AML/CFT expertise with the organization.

Here are 10 of the most prominent FATF Observer Organizations :

- African Development Bank

- Asian Development Bank

- European Central Bank (ECB)

- Europol

- Inter-American Development Bank (IDB)

- International Monetary Fund (IMF)

- Interpol

- Organization for Economic Co-operation and Development (OECD)

- United Nations (UN) – several security bodies

- World Bank

6. Complying with the FATF Standards

While the FATF recommendations are not legally binding, countries are expected to toe the official FATF line and implement the latest recommendations where possible. If not, they face being added to the “Non-Cooperative Countries or Territories” (NCCTs), better known as the FATF Blacklist, which is a quick way of getting ostracized from international trade.

6.1 FATF Assessment Methodology: How does the FATF check for compliance?

The FATF’s compliance mechanism and methodology evolved over time, first with 2004’s Methodology for Assessing Compliance with the FATF 40 Recommendations and the FATF 9 Special Recommendations and next, 2009’s AML/CFT Evaluations and Assessments: Handbook for Countries and Assessors,which outlined relevant criteria to effectively evaluate if a specific country is compliant with the FATF Recommendations.

null

null

null

null

The task force evaluates a country’s performance based on a 2-part assessment methodology that looks at:

1. Technical compliance – a country’s legal and institutional framework, procedures and the competence of authorities

2. Effectiveness assessment – what results does the country’s legal and institutional framework deliver?

The FATF does consider the various differences between countries and difficulties for all members to implement all the recommendations. Therefore the organization sets a minimum of actions required to meet a standard, that provides countries with some domestic flexibility. The required standard encapsulates all actions that a country should have implemented in its regulatory and judicial systems as well as preventive measures for the corporate, public and educational sectors.

In order to protect Non-Profit Organizations (NPOs) from money laundering, the FATF and intergovernmental organizations like the World Bank, OECD and IMF demand transparency from them and frequently monitors them to check their bona fides.

FATF’s Recommendations are legally non-binding guidances, however, the organization will take action if it assesses that a jurisdiction hasn’t met its minimum standards or implemented them effectively enough. Countries that are lax on AML/CFT guidances risk being added to the FATF’s graylist or blacklist, published in two documents and assessed three times a year.

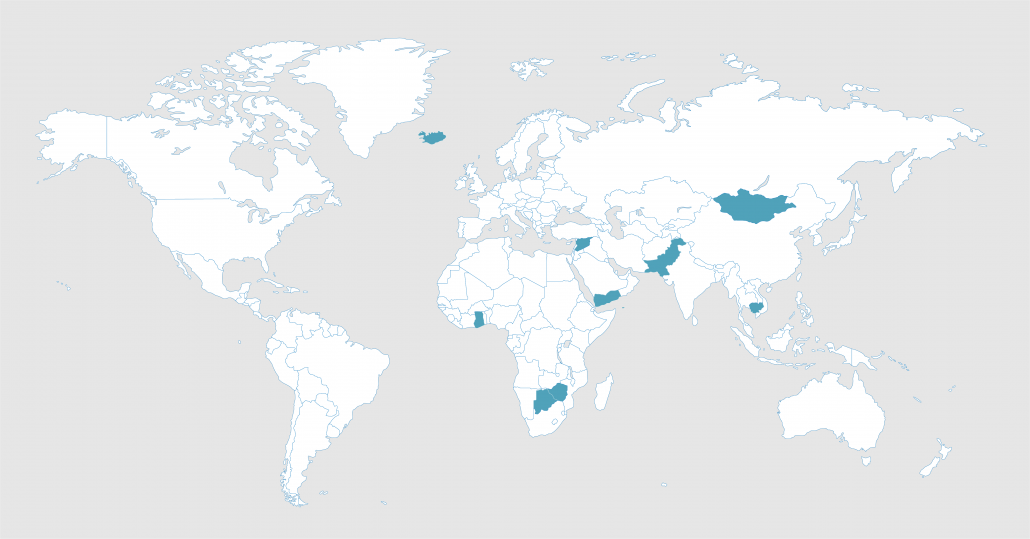

6.2 The FATF graylist of high-risk monitored countries

Countries with high-risk AML/CFT policy weaknesses are continuously monitored by the FATF and added to a graylist of countries that are required to improve their systems within a set time frame or risk being blacklisted.

This approach usually pays quick dividends.While FATF monitored 68 countries in 2018 on their graylist, there are currently (November 2019) only 8 countries on their High-Risk list. In 2019, FATF added Mongolia, Iceland and Zimbabwe to its greylist and cleared Ethiopia, Sri Lanka and Tunisia during their October 2019 plenary. These are the current 8 graylisted FATF countries:

- Botswana

- Yemen

- Ghana

- Zimbabwe

- Syria

- Pakistan

- Mongolia

- Iceland (recently added)

FATF puts Pakistan on “dark gray list”

In June 2018, FATF added Pakistan to its graylist, giving the country 15 months to implement a 27-point action plan or risk being put on the FATF blacklist. In its last review in October 2019, Pakistan reportedly only managed to adhere to 6 of the required points. The FATF has issued a final warning to Pakistan to comply before its next review in February 2020. Some analysts refer to this ultimatum as the FATF’s “dark gray list”, the final step before blacklisting.

6.3 The FATF blacklist of Non-Compliant Countries and Territories (NCCTs)

The FATF has issued its blacklist, officially known as “Non-Cooperative Countries or Territories” (NCCTs) since 2000, which comes with devastating economic and political punishment, such as global economic sanctions, trade embargoes, boycotts and refusal of financial aid or loans.

The current FATF blacklist consists of countries Iran and North Korea, but it is expected that Pakistan will be added due to their insufficient measures against growing terrorism financing, following their next review in February 2020.

What are the consequences for a country added to the FATF blacklist?

- Economic sanctions which prohibit it from exchanging goods and services with other countries

- Lack of loans and financial aid from global institutions like the IMF and World Bank and other countries

- Worldwide trade embargoes, making it impossible to export goods and forces the country to use the international black market

- International boycotting- a withdrawal of social relations by other countries and organizations.

Therefore, any country put on FATF’s greylist will devise and implement a serious AML/CFT action plan in conjunction with the FATF to ensure their status isn’t escalated.

7. The FATF and the Cryptocurrency Industry

With virtual currencies only springing into existence on January 3, 2009, the day the Bitcoin network went live, it appeared until the latter half of this decade that the FATF was either ignoring the cryptocurrency industry or didn’t know what to do with it just yet. The answer is likely a combination of both.

Certainly though, crypto’s dark early association with money laundering, terrorism funding and other illicit crimes like drug sales and human trafficking put the industry in the FATF’s crosshairs for a while. However, with the meteoric rise of Bitcoin and Initial Coin Offerings (ICOs) in 2017, it was clear that global authorities couldn’t wait any longer and risked playing catchup for the foreseeable future if they didn’t take action.

As the world’s biggest crypto market, the United States’ presidency of the FATF in 2018/2019 presented a highly opportune time for the superpower to take the lead and introduce its domestic crypto policy to the rest of the world-specifically its long-established “travel rule” that’s ubiquitous in traditional banking.

Marshall Billingslea, the U.S.-represented FATF president and Assistant Secretary for Terrorist Financing of the U.S. Treasury, made his intentions clear at his first officiating plenary in October 2018. His other plenaries in February and June 2019 were defined by a clear outcome-based agenda, which culminated in the adoption of a custom FATF travel rule recommendation extending to over 200 countries, a mere 10 days before the end of his presidency. China’s new FATF president Xiangmin Liu now carries the torch, with his first plenary focusing on stablecoins and digital identity.

7.1 The U.S. and China-led Plenaries (2018-2019)

October 2018 Plenary:

The FATF Plenary narrowly defines virtual assets (VA) and virtual asset service providers (VASPs), amending its Recommendation 15 and glossary to elucidate to which commercial entities and activities the FATF requirements apply in relation to virtual assets. This lays the foundation for its regulatory changes enacted in 2019.

February 2019 Plenary:

The FATF shakes the cryptocurrency industry and especially virtual asset service providers (VASPs) by introducing Interpretive Note to Recommendation 15, paragraph 7(b)-R16, AKA the FATF’s “crypto travel rule”.

June 2019 Plenary:

After consulting with the private sector in May 2019 at its annual PSCF, where little progress is made, the FATF makes the changes to Recommendation 16 permanent, thereby requiring countries to ensure that VASPs collect and share beneficiary and originator information during virtual asset transmittals exceeding 1000 USD/Euro.

October 2019 Plenary:

The first plenary under China’s presidency takes aim at stablecoins and other emerging assets (in an indirect response to Facebook’s Libra project) and also looks at the usage and reliability of digital identification systems.

The FATF states that it is “ actively monitoring emerging assets including stablecoins and will continue to “examine their characteristics and risks, and consider further clarifications on how the FATF standards apply to stablecoins and their service providers, as well as whether further updates are necessary.”

7.2 Conclusion

With the June 2020 deadline approaching and China’s recently announced central bank digital currency (CBDC) coming soon, 2020 is shaping up to be another pivotal year in the evolving relationship between the FATF and the cryptocurrency industry.

Glossary

| AML | Anti-Money Laundering |

| FATF | Financial Action Task Force |

| GAFI | Groupe d’Action Financière |

| OECD | Organization for Economic Co-operation and Development |

| CFT | Combating the Financing of Terrorism |

| KYC | Know-Your-Customer |

| FIU | Financial Intelligence Units |

| FI | Financial Institutions |

| VASP | Virtual asset service provider |

| FATF 40 | 40 FATF Recommendations |

| FSRB | FATF-Style Regional Bodies |

| FinCEN | Financial Crime Enforcement Network |