Table of Contents

- 3.1 FATF Blacklist: High-Risk Jurisdictions subject to a Call for Action – Iran and North Korea

- 3.2 FATF graylist: Jurisdictions under increased monitoring

- 3.3 Mutual evaluations of Korea and the United Arab Emirates

- 3.4 Follow-up report of the United States

4. Other Strategic Initiatives

- Combating the laundering of proceeds of the illegal wildlife trade

- Promoting and facilitating more effective supervision at the national level

- Strategic review of the FATF Global Network assessment processes

- FATF Presidency 2020-2022

1. Overview

The Financial Action Task Force (FATF) held its FATF Week (16-21 February) and FATF Plenary (19-21 February) in Paris, France. Over 800 associated FATF delegates from 205 jurisdictions, 9 FATF-Style Regional Bodies (FSRBs) and partners like the International Monetary Fund (IMF), United Nations (UN) and World Bank attended the week-long anti-money laundering and counter-terrorist-funding (AML/CFT) gathering. Participants discussed and updated each other on the FATF’s Strategic Priorities and Country-Specific Processes, as well as other Strategic Initiatives to combat illicit wildlife trade proceeds and international terrorism funding.

FATF Plenary Outcomes: Public Statement Summary (Tl;dr)

The FATF Plenary culminated in a public statement on 21 February to relay its achieved outcomes.

Here are the FATF February Plenary’s main outcomes (discussion follows below):

- The October guidance paper on digital identity was officially adopted

- The implementation of Recommendation 16, FATF’s equivalent of the U.S. Bank Secrecy Act (BSA)’s Travel Rule for virtual asset transfers, was discussed and is being closely monitored.

- Korea and the United Arab Emirates (UAE)’s mutual evaluation reports on domestic AML/CFT systems received a pass rate, but areas for improvement were highlighted

- A follow-up review of the United States’ 2016 mutual evaluation and its new virtual asset regulatory measures received a near-clear score

- Iran and North Korea’s failure to implement ML/TF action plan points kept keeps them on the “Call-to-Action” blacklist.

- Pakistan remained on the graylist, with another review in June

- “Increased monitoring “Graylist”: T&T removed, 7 new countries added.

- FATF discussed efforts to fight money laundering stemming from illegal wildlife trade

- Germany’s Dr. Marcus Pleyer was voted in for the first-ever 2-year presidency term.

- Reported on financing developments of terrorist groups like ISIS and Al-Qaeda

2. FATF’s Strategic Priorities for 2019/2020

The FATF followed up from its October 2019 Plenary with an in-depth discussion of their two major strategic initiatives for 2019/2020:

- Understanding and leveraging the use of digital identity (“Digital ID”)

- Mitigating the money laundering and terrorist financing (ML/TF) risks associated with virtual assets

2.1 Digital Identity- FATF adopts October guidance

The February Plenary formally adopted a Digital Identity guidance, first introduced during the October Plenary, that explains “how digital ID systems can meet FATF customer due diligence (CDD) requirements and assist governments and financial institutions worldwide when applying a risk-based approach to using digital ID systems.”

This follows the FATF’s concern around the rapid growth in digital financial transactions and their recognition of the lack of sufficient identification and verification controls to stem misuse.

The FATF guidance on digital identity (“Digital ID”) will help governments, financial institutions, and others accurately identify and verify customers, by using a risk-based approach to setting up Know-Your-Customer (KYC) systems that will align with regulators’ Customer Due Diligence (CDD) requirements.

The guidance is technology-agnostic and lists both the risks and benefits of digital ID systems, such as financial inclusion, better security and reliability and reduced dependence on error-prone human-controlled systems.

2.2 Mitigating ML/TF risks of Virtual Assets

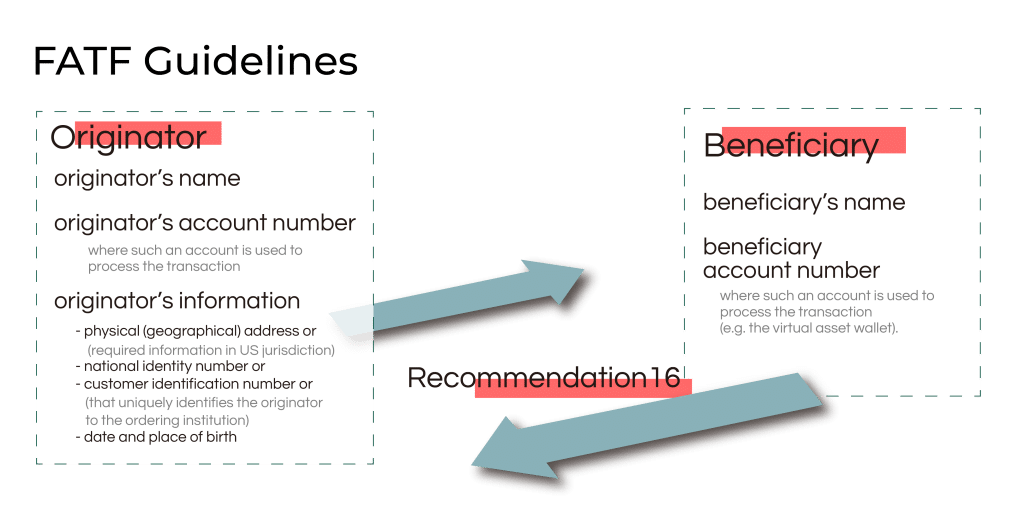

Recommendation 16 “Travel Rule”

Recommendation 16 has to be implemented by countries and their virtual asset service providers (“VASPs”) by June 2020, following the 12-month review process. In order to achieve compliance with Rec 16, originator and beneficiary VASPs will have to compliantly share customer identification data with each other.

In their 21 February Public statement, the FATF stated:

-It had been keeping a close eye on the implementation of new AML/CFT measures for virtual assets, such as the updated R.16 Standard.

-It had discussed countries’ progress so far and taken into account input from the private sector on incoming technical solutions. This will likely be further explored in May 2020’s Private Sector Consultative Forum (PSCF).

Stablecoin regulation

– In June 2020 FATF will inform the G20 on its assessment of ML/TF risks that stablecoins (stable-asset backed virtual representations of fiat currencies) pose and how the FATF Standards apply to them.

3. Country-Specific Processes

Here is a summary of country-specific outcomes following the February Plenary:

| Blacklist ( “Call to Action”) | -Iran -North Korea |

| Graylist (“Increased Monitoring” – new entrants | -Albania -Barbados -Jamaica -Mauritius, -Myanmar -Nicaragua -Uganda |

| Positive reports | -Removed from list: Trinidad & Tobago -Mutual evaluations: Korea and the UAE -Follow-up reports: United States |

3.1 High-Risk Jurisdictions subject to a Call for Action (FATF Blacklist)

-Iran

The FATF took a strong stance against Iran’s continuing failure to implement action plan measures promised in 2016 in accordance with the United Nations’ Palermo and Terrorism Funding conventions, despite an initial deadline of January 2018.

In a public statement on high-risk countries published on 21 February, the FATF has revoked its suspension of counter-measures on Iran and asked member countries to take punitive action. This includes the reviewing and ending of countries’ relations and business dealings with Iranian financial institutions, in order to protect the global financial system from Iran-originating money laundering (MF), terrorism funding (TF) and weapons of mass destruction-based proliferation financing (PF). These new measures will all but cut off Iran from world banking.

Iran is now once again on FATF’s so-called blacklist, now called the High-Risk Jurisdictions Subject to a Call for Action (previously the Non-Compliant Countries and Territories) and FATF will only consider suspending this measure until Iran has satisfactorily completed its AML/CFT action plan in full.

-North Korea

The FATF has asked its members to continue applying sanctioning counter-measures on North Korea due to the country’s ongoing ML/TF/PF deficiencies and the threat it poses to the global financial system.

3.2 Jurisdictions under increased monitoring (FATF Graylist)

On 21 February 2020, the FATF also published an updated “graylist” of new countries that require increased monitoring to deal with strategic AML/CFT deficiencies.

-Pakistan

Pakistan has escaped the FATF’s “Call to Action” blacklist yet again after the terrorism-afflicted Asian nation addressed 14 out of 27 areas on FATF’s action plan. However, the FATF “strongly urges” Pakistan to finish its action plan by its June Plenary and make quick progress in its efforts to fight terrorism funding, or it remains in danger of being added to FATF’s blacklist.

-Trinidad & Tobago off graylist

Trinidad & Tobago, a member of the Caribbean FATF (CFATF), was removed from the list after having demonstrated that it no longer requires increased monitoring, having made significant progress in remediating its AML/CFT deficiencies.

-7 New Jurisdictions added to Graylist

FATF has added 7 countries for having “strategic AML/CFTdeficiencies”, and has developed an action plan with each jurisdiction to improve their AML/CFT systems. The countries are:

- Albania

- Barbados

- Jamaica

- Mauritius

- Myanmar

- Nicaragua

- Uganda

The FATF’s so-called graylist of countries with strategic AML/CFT deficiencies now contains 18 member countries.

3.3 Mutual evaluations of Korea and the United Arab Emirates

-Korea

The FATF and Asia/Pacific Group on Money Laundering (APG) did a joint assessment of Korea’s legal and institutional AML/CFT framework, which they found to be satisfactory and translating into good results.

The FATF was impressed with Korea’s evolving financial intelligence protocols and their ability to recover illicit financial proceeds, but mentioned that more attention must be given to non-financial businesses, misuse of legal persons and making ML prosecution and investigations a priority.

-United Arab Emirates (UAE)

The UAE was also the subject of a joint assessment by FATF and the Middle East & North Africa FATF (MENAFATF). The Plenary approved of the jurisdiction’s improved AML/CFT measures, such as its national risk assessment and efficient measure to investigate and prosecute terrorism funding in the region, but called on the UAE to, among other things, improve money laundering investigations and prosecutions and freeze TF-associated funds immediately.

3.4 United States follow-up report

The FATF positively reviewed AML/CFT improvements made by the United States of America following its 2016 mutual evaluation report. These include the U.S. Treasury’s Customer Due Diligence (CDD) and beneficial ownership requirements. FATF will make their findings public later.

The U.S. was the only other country besides Switzerland to volunteer for an assessment of its compliance with FATF’s virtual asset guidance.

4. Other Strategic Initiatives

-Illicit Wildlife Trade Proceeds

The Plenary also discussed the FATF’s efforts to combat the proceeds of illegal wildlife trading and considered new measures to establish more efficient supervision from countries’ governments.

-New FATF president

The Plenary officially elected Dr. Marcus Pleyer of Germany to follow up China’s Xiangmin Liu as the FATF president. Currently the organization’s vice-president, Dr. Pleyer will take office on the 1st of July 2020 and be the first president to carry a two-year term (2020-2022).

-ISIL and Al Qaeda

The task force adopted the 12th update on how ISIL, Al-Qaeda and its network of terrorist organizations receive funding. The FATF identified a worrying trend- associate terror groups increasingly create their own income streams instead of depending on Syrian and Iraqi donors. This gradually decentralizing TF poses a growing new threat to the FATF’s 205 member jurisdictions.

Conclusion- What’s Next for FATF in 2020?

While it has been a busy week for the FATF, the Plenary delivered no major new surprises to the virtual asset industry. All eyes are now on the FATF’s important June 2020 plenary where the FATF will assess progress made in regards to the implementation of the Travel Rule.

The FATF will engage the virtual asset industry in the next Private Sector Consultative Forum in Vienna (4-8 May), building on the work that was initiated last year.

Private enterprises will be able to confer with the FATF and the outcome of this forum should influence the June plenary.

In the meantime, the FATF now shifts its short-term focus to Africa and Asia, and will convene in plenaries with its African FSRBs as follows:

- GABAC (Central Africa): March 2020

- ESAAMLG (E.and S.Africa): April 2020

- MENAFATF (Middle East & N. Africa): April 2020

- GIABA (West Africa): May 2020

View the FATF’s 2020 calendar here